Annualized roi

Common Mistakes in Calculating ROI. Enter the total Amount Returned and the end date.

There S More To Value Investing Than Low Prices Morningstar Value Investing Investing Ishares

Allows the reader to calculate the present-day value of an investment based on inflation-adjusted projections of its future earnings.

. ROI Ending value Beginning value Cost of investment Annualized return. But obviously a return of 25 in 5 days is much better than 5 years. Likewise the annual performance rate can be calculated using P G P 1 n - 1 where P equals initial investment G equals gains or losses and n equals the number.

Using the annualized return as the only criterion alternative 3 would be the most profitable investment with 1333 annualized return compared to 914 and -286 for alternatives 1 and 2 respectively. Enter the Amount Invested and the date the investment was made Start Date. ROI Ending value Beginning value 1 Number of years 1.

1 Thats a long look back and most people arent interested in what happened in the market 90 years ago. On an annualized basis. Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers.

The IRR indicates the annualized rate of return for a given investmentno matter. For example a return of 25 over 5 years is expressed the same as a return of 25 over 5 days. Annualized ROI is most applicable for investing in financial products like stocks mutual funds and bonds.

They help their neighbors serve their communities and provide their expertise. NPV net present value. Lets assume that a person buys a stock on January 1st for 1250 and turns around to.

Annualized ROI Formula. When comparing the results of two calculations computed with the calculator oftentimes the annualized ROI figure is more useful than the ROI figure. In this formula the ROI is the average annual gain or loss made on a share of investment since the initial investment.

Approximate Annualized Yield in terms at the beginning of the slab. Calculate this formula as. Over the long haul reinvesting dividends really adds up helping to exponentially increase the value of your portfolio.

How to calculate ROI Return on Investment Calculating annualized return. For outstanding Balance of Rs. And net cash flow at time including the initial value and final value net of any other flows at the beginning and at the end.

Solving for x gives us an annualized ROI of 62659. This is less than Investment Bs annual return of 10. Disburses loans worth Rs.

Here is an example of an annualized return calculation. Is education loan worth taking a risk for a course abroad. It is a solution satisfying the following equation.

Volunteers in the United States hold up the foundation of civil society. Measures the return an investment generates in a single year. Why you should consult with an expert financial advisor for better ROI.

You display the answer as a percentage. Annualized ROI Final value of investment - Initial value of investment Initial value of investment x 100. Effective Annualized rates of return on Banks Re-investment Deposit Plan Kamadhenu Deposit is based on quarterly compounding of.

So lets look at some numbers that are closer to home over a 30-year span. The Current Estimated National Value of Each Volunteer Hour Is 2995. Annualized Total Return.

The internal rate of return IRR which is a variety of money-weighted rate of return is the rate of return which makes the net present value of cash flows zero. The geometric mean is the average of a relevant set of quantities multiplied together to produce a product. The historical average annual return from 1928 through 2021 is 1182.

If alternative 3 is included in the comparison the multiple-period ROI needs to be used to consider the different tenors. An annualized total return is the geometric average amount of money earned by an investment each year over a given time period. 50 Lakh to less than Rs 100 Cr.

An online statistical geometric mean calculator to find the geometric mean value of the given numbers or statistical data when all the quantities have the same value. Net Present Value NPV. ROI 24 20 20 02 20.

Return on Assets ROA. Get expert advice tailored to your use cases. The ROI Calculator includes an Investment Time input to hurdle this weakness by using something called the annualized ROI which is a rate normally more meaningful for comparison.

To check if the annualized return is correct assume the initial cost of an investment is 20. Where. You simply buy new shares with every dividend payment and let the power of compounding take over.

As mentioned above one of the drawbacks of the traditional return on investment metric is that it doesnt take into account time periods. ROI - Practical Examples ROI Formula. Read Full Case Study.

ROI or return-on-investment is the annualized percentage gained or lost on an investment ROR or rate-of-return is the same calculation. It is calculated as a geometric average to. Get started with Mero today.

Reinvesting your dividends allows you to increase the number of shares that you own without forking over a dime in new money. After 3 years 20 x 1062659 x 1062659 x 1062659 24. ROI indicates total growth start to finish of an investment while IRR identifies the annual growth rate.

Annualized ROI 1 Net Profit Cost of Investment 1n 1 x 100 Accurate ROI calculations depend on factoring in all costs not merely the initial cost of the investment itself. You can change the dates by changing the number of days. For outstanding Balance of less than Rs.

Its calculated by dividing the ROI by the number of years the investment is held.

Check If Your Investment Portfolio Beats The Average Return Investing Investment Portfolio S P 500 Index

How To Do Better When Investing For Trusts And Uhnw Individuals Investing Individuality Trust

However You Re Defining Risk In This Scary Stock Market You Re Probably Wrong Marketwatch Stock Market Personal Financial Planning Standard Deviation

25 Years Annualized Returns By Asset Class Investment Banking Investing Banking

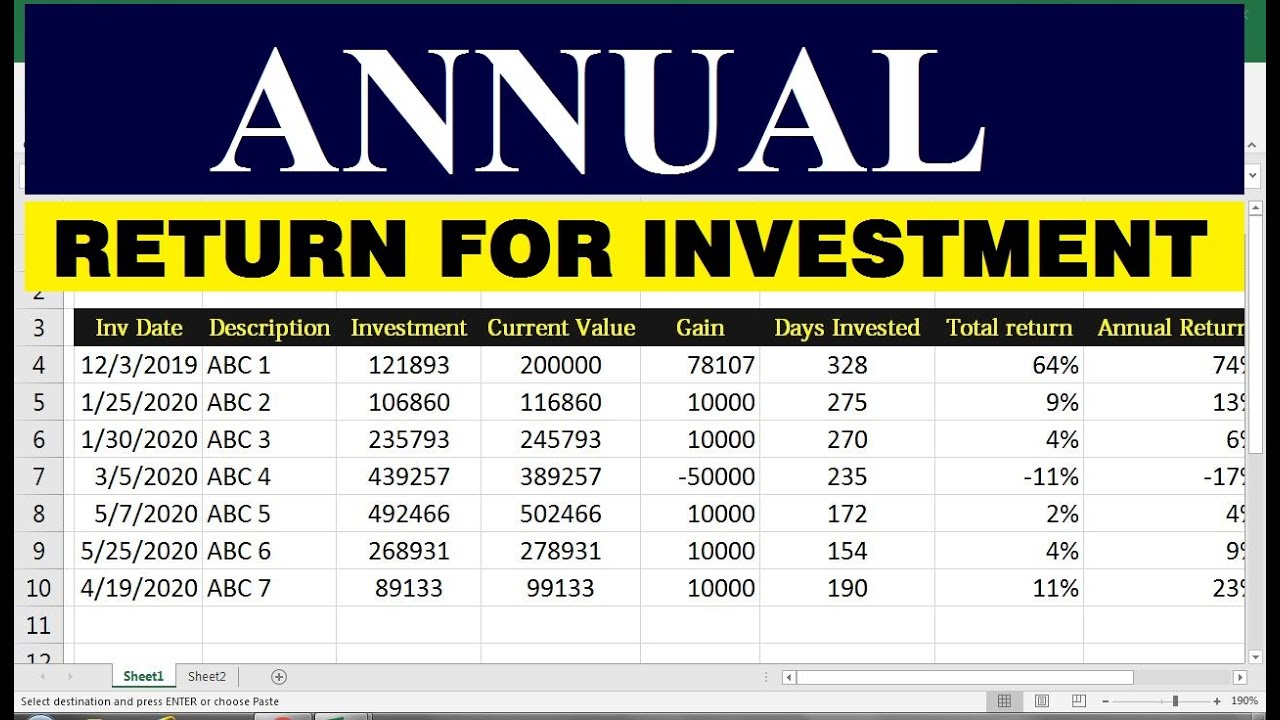

How To Annualized Returns In Excel Excel Return Investing

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

S P 500 Historical Annual Returns Yearly Calendar S P 500 Index Online Calendar

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing

Adwords Gains 3 New Cross Device Attribution Reports Adwords Paid Search Digital Marketing Company

What S The Worst 10 Year Return From A 50 50 Stock Bond Portfolio Finances Money 10 Years Lost Money

20 Year Returns By Sector Investors Economics Asset

Rolling Return Systematic Investment Plan Take Money Investing

Types Of Activity Turnover Ratios Financial Ratio Accounting Books Financial Analysis

Annualized Returns By Asset Class From 1999 To 2018 Financial Samurai Investing Ways To Get Rich Investing Money

Dispersion Of Returns Across Asset Classes Old Quotes Graphing Retirement Benefits

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

10 Year Cagr S P500 Projection Investing Stock Market Personal Finance